What's your LPO strategy for 2013?

LPO – no longer myth but reality!

The global legal process outsourcing (LPO) industry has been growing at more than 30% annually for the past five years, analysts report. In the current economic climate, this makes the LPO industry one of the fastest growing in the services sector.

While the initial growth of the LPO sector was driven by the North American market, the sector has over the past two years gained traction even in the UK. Some large UK law firms have collaborated with third party LPO suppliers, while a few firms now operate their own LPO captive centres. General counsel of the FTSE 500 are being driven by CEOs, CFOs and procurement directors to find “value for money” propositions in delivering legal services, and many are now keenly looking at the LPO option. The likes of the Royal Bank of Scotland now have a separate panel for alternative legal services suppliers.

LPO is no longer an “offshoring concept”. LPOs, such as NewGalexy, now operate fully serviced onshore delivery centres in the UK, offering clients the flexibility and comfort of choosing their own preferred form of delivery – whether onshore and/or offshore. This has now given LPOs further “reach” to service a larger market, and the ability to deliver niche services for focused sectors such as banking, financial services and insurance; engineering and construction; energy, oil and gas; and public authorities.

What should I outsource?

First-time users of LPO services often ask which legal tasks should they consider outsourcing to LPOs. While the answer to that question depends on the particular need of the business, NewGalexy recommends two useful techniques – explained below – to help clients identify which legal tasks should be outsourced to LPOs.

De-constructing legal transactions

Consider “breaking down” legal tasks and transactions, and mapping out “who does what”. By using this de-construction process, you can analyse (a) which elements of the legal transaction need genuine “high level” legal expertise, and (b) which tasks have an element of process to them, do not need such high level expertise and can therefore be done more effectively by LPOs. So, for example, looking at a litigation transaction, you should consider whether certain elements of the electronic discovery process can be outsourced to LPOs. It is now becoming increasingly common (especially in North America) for LPOs to carry out bulk work in relation to electronic discovery and document review by using technology and sophisticated processes to deliver these services.

Almost all legal transactions have an element of process to them. Let’s consider an M&A transaction. This can be broken down into various elements, as illustrated in diagram 1.

Consider the various elements of the M&A transaction as shown in the diagram. The process of collecting and indexing electronic and physical documentation does not need a high level of legal expertise, and by ensuring that systems and quality processes are in place this task can be allotted to a LPO with relative ease.

LPOs can also be assigned the task of reviewing and reporting on documents which form part of the legal due diligence process. You should consider “pre-agreeing” protocols for document review, checklists, and templates for reporting styles. Depending on the complexity of the transaction, the “issues report” can either be completed by law firms/in-house lawyers or by LPOs (in consultation with the law firm/in-house counsel). However you decide to allot this task, I suggest that the LPO provider is kept involved in the issues report process, as the bulk of the legal due diligence exercise has been completed by the LPO provider. The next two levels of the transaction, i.e. the drafting and negotiation of the sale and purchase agreement and signing off on the M&A transaction with recommendations, clearly require a high level of legal expertise and are tasks which should be assigned to a law firm/senior in-house lawyer.

By de-constructing an M&A transaction in this manner, you can optimise the use of LPOs and law firms/in-house lawyers, save time and money and ensure that the overall transaction is delivered more effectively.

Identifying and outsourcing tasks

A 2011 survey report on LPOs, published by Vantage Partners for the annual meeting of the Association of Corporate Counsel (ACC), concluded that a majority of in-house lawyers felt that routine legal work, low value/low risk contracts, and document review and management consumed far too much time relative to the value of the tasks; that they would rather stop doing such tasks; and that they would much prefer to concentrate on more valuable work, engage more with the business and provide more input on strategic planning.

LPOs such as NewGalexy allow in-house lawyers and law firms to concentrate on more valuable work by providing managed legal services (at competitive fixed pricing) for routine legal tasks.

You should consider which legal tasks are routine, consume a lot of time, cost more and do not allow you and your team to concentrate on valuable work.

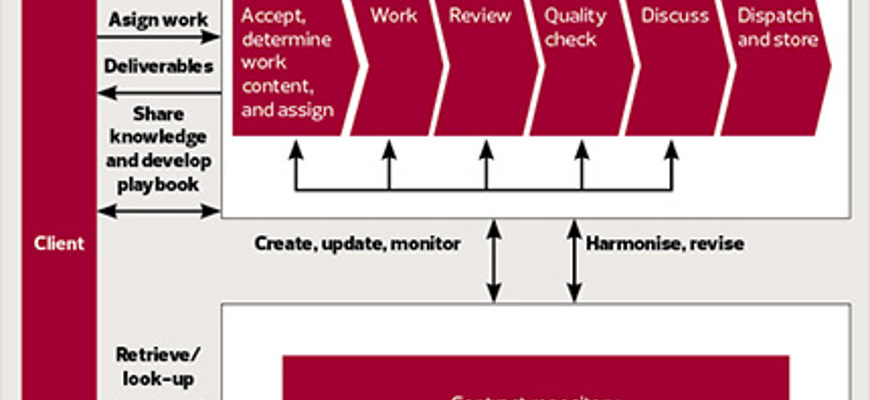

Outsourcing routine commercial contract work such as software licence agreements, confidentiality agreements, standard public and private sector procurement contracts, and leases, might be a good starting point. LPOs can provide clients with “end-to-end solutions” for such routine contract work by using a series of processes and quality control methods to ensure optimum quality of service is delivered to the client. I have illustrated in diagrams 2 and 3 the management program for routine commercial contracts which NewGalexy runs for its clients, and the workflow model which NewGalexy often follows for contract review services.

Using a playbook methodology

In my experience, the most successful LPO engagements have been those where LPOs and their clients have worked in collaboration to develop a set of protocols for the work to be undertaken by the LPO. I recommend that while outsourcing routine legal work, you engage with your LPO provider to develop a “playbook”. The playbook will allow you to set standards on “what you expect” from the LPO provider, and allow the LPO provider to clearly understand “what it needs to deliver to you”. This methodology often ensures that the work is not being overengineered by the LPO and is being delivered to your full expectation.

The playbook will include:

- A step-by-step workflow and review manual. In the case of contract review services, I often suggest to clients a “traffic light” system in relation to contract risks – contract provisions which clients cannot accept (“red light”); contract provisions which need to be mitigated with pre-approved language before they can be accepted (“amber light”); and contract provisions which clients would be willing to accept (“green light”).

- A mechanism for discussing and agreeing the timelines for responding to service requests.

- Pre-agreed means and lines of communication with relevant members in your business.

- The LPO’s reporting requirements.

- Service levels and quality assurance process which the LPO will follow. As an example, NewGalexy follows a “four eyes review” quality control process for all work it undertakes for its clients. I recommend that you ask your LPOs to maintain a service quality log in the form of a report that highlights issues that may have arisen both in terms of legal matters and engagement handling. Errors, complaints, rework or systemic issues should also be logged and highlighted by the LPO.

Changing tide

The LPO sector has matured over the years. The first growth phase for the LPO sector was driven substantially on the cost arbitrage argument. That trend is now changing as in-house counsel and law firms are realising that the long term benefits of using LPOs extend beyond substantial cost savings. LPOs such as NewGalexy offer clients customised services often focused on the specific needs of an industry, such as compliance and legal risk management services for the banking and financial services sector. LPOs not only offer businesses scalability, but now offer value added processes using technology which ensures long-term sustainable solutions for these businesses.

LPOs are here to stay, and as LPOs with the right business model gear up for a buoyant year, there are genuine opportunities for law firms and in-house legal departments to leverage on the many benefits LPOs offer by partnering with the right service provider in 2013.

In this issue

- Off on the wrong track

- Cadder, EU style

- Common grazing shares – where are we now?

- Is it time to stop baffling our clients/customers?

- Copyright and collaboration: a dose of bad medicine?

- Reading for pleasure

- Opinion column: Ken McCracken

- Book reviews

- Council profile

- President's column

- New build: new process

- Up or down? Digging deeper

- Who volunteers to be discriminated against?

- What's your LPO strategy for 2013?

- Tailored to suit

- Perfect storm less than appealing

- Separate but legal

- In and out of court

- Coming to a court near you

- Which way will the wind blow?

- Entitled to be aggrieved

- Funds less restricted

- Statement or Budget?

- Local leg-up

- Scottish Solicitors' Discipline Tribunal

- Answering for error

- The other alternative

- Remoteness and risk

- Paralegal Scheme extended

- Proposed rule change

- Law reform roundup

- An innocent loan or questionable funds?

- Ask Ash